Did you know that Amazon has taken out Google and Facebook in growth for the recent quarter? Where the e-commerce market and the advertising arena are experiencing some initial turbulence due to the rising inflation, Amazon seems to have it all worked out. In 2021, Amazon dominated 14.6% of the US digital ad market, coming very close to the top players like Google (26.4%) and Facebook (24.1%).

In the face of a recession approaching, Amazon’s ad revenue has taken a jump of 18% in this quarter. Businesses are concerned about the vulnerability of advertising opportunities offered by social media giants like Facebook. So, they are allocating more of their budget to Amazon where there is a lesser impact of scrutiny and a higher return on investment.

Currently, Amazon is being viewed as the best place for brands to buy ads. It has a wealth of data on what consumers are buying, allowing advertisers to target their ads at the ideal prospects they’re trying to reach. Another reason is its growing advertising presence on non-marketplace platforms. Amazon is selling ads on other properties like its Freevee video streaming service and its Twitch gaming site. It also sells ads on websites it doesn’t own, just like Google does.

Advertising Cost on Amazon in 2022

Amazon advertising is super popular and an essential part of selling on Amazon. The cost of these ads will depend on factors like the ad type, the CPC (cost-per-click), the bidding strategy, the keywords that you choose, the competitor brands, etc.

Amazon Advertising follows a PPC model, so an Amazon seller only pays when an ad is clicked on(CPC). CPC is the amount that Amazon charges Amazon sellers or advertisers for every click that their ad gets. The average CPC is $0.81. But this is not fixed.

Fab On Go PPC specialists can analyze and give you insights on CPC.<Get in touch> with them and they will take care of every advertising move determining your PPC success.

Where are Advertisers and Sellers Allocating Most of the Budget?

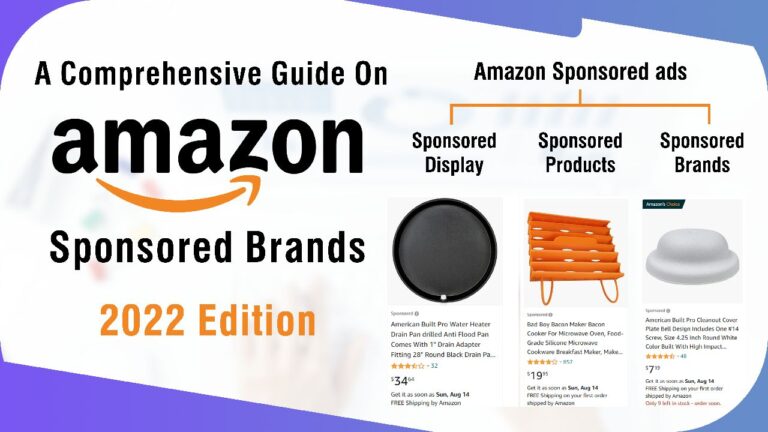

The amount that advertisers want to spend on Amazon ads begins with thinking about what goals they want to fulfill and the objectives they want to achieve. Every ad format on Amazon serves a different purpose. Amazon sellers have three different ad types to work with- Sponsored Products, Sponsored Brands, and Sponsored Display. Out of those, Sponsored Products are the most popular they’re easy on the pocket and offer a simple setup to advertise your products.

But even this outlook of only considering the cost factor is changing. Today, one has to take note of all the benefits that ad choices can bring- exposure, brand awareness, sales, etc. Let’s take a look at Sponsored Brands. These have the brand logo, tagline, and a range of products for advertising in that ad (all customizable). You can make these Amazon ads look impressionable and redirect shoppers who click on them to a designated landing page or Amazon storefront. All of this results in the highest RoAS among the three of them.

Sponsored Display has gained massive popularity though it is slightly more expensive. This is where brands are looking to boost their visibility and grow their presence on Amazon. This is where they are spending. These Amazon ads have a lower RoAS but they come with the advantage of promoting your products and targeting customers both on and off Amazon.

Rising Costs, Ad Spend and Amazon Sellers

CPC is indeed on the rise. The CPC on Amazon’s US site has increased by 22% from 2021 to 2022. But these ads on Amazon still cost lesser than Google and Facebook ads. Moreover, these ads have first-party sales data and are thus immune to the loss that comes with the deprecation of the 3rd party cookie as experienced with Facebook and Google.

With more than 40 percent of online sales taking place on Amazon, companies are already spending between $100 to $50,000 per month on Amazon advertising. And, this is going to increase because of their decreasing trust in other advertising platforms and more economic and robust advertising options available on Amazon.